The camping essentials - I've found a bargain which you all need to know about thread...

By

The Other Steve,

in Chat

-

Recently Browsing 0 members

- No registered users viewing this page.

-

Latest Activity

-

I wouldnt put it past Courtney Love to make an appearance - not with Hole - but as a guest or as a DJ or something She recently appeared with Green Day https://www.stereogum.com/2253522/watch-courtney-love-billie-joe-armstrong-cover-cheap-trick-tom-petty-in-london/news/ And also recently DJ'd at the Portrait Gallery in London for Vivienne Westwood https://www.cnn.com/2024/03/21/style/courtney-love-national-portrait-gallery-lotw/index.html She lives in the UK now and has been doing lots of press events. No matter what you think of her, she likes to be seen, and what better place than glastonbury?

-

Being able to choose different channels/genres and have others be able to choose… then looking at each other/around at people dancing out of sync and maybe switching. Listening to the ridiculous shuffling. It’s very silly but fun if you are in the mood. At Glastonbury though, the main appeal if you were in the area would probably be that it wouldn’t be rammed or involve a trek across the site.

-

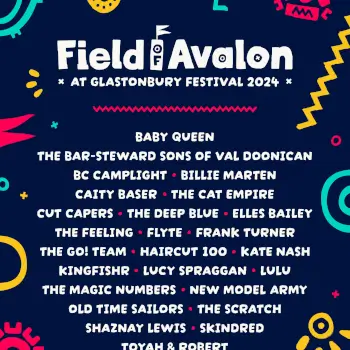

Shaping up nicely. Will be spending most of my evening in the big top unless I’m given a suggestion elsewhere!

-

By WhoOdyssey · Posted

I think Aitch has a decent fanbase. Although we'll see how true that is soon as he released his first single in quite a while today.

-

-

Latest Festival News

-

Featured Products

-

Monthly GOLD Membership - eFestivals Ad-Free

2.49 GBP/month

-

-

Hot Topics

-

Latest Tourdates

Recommended Posts

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.